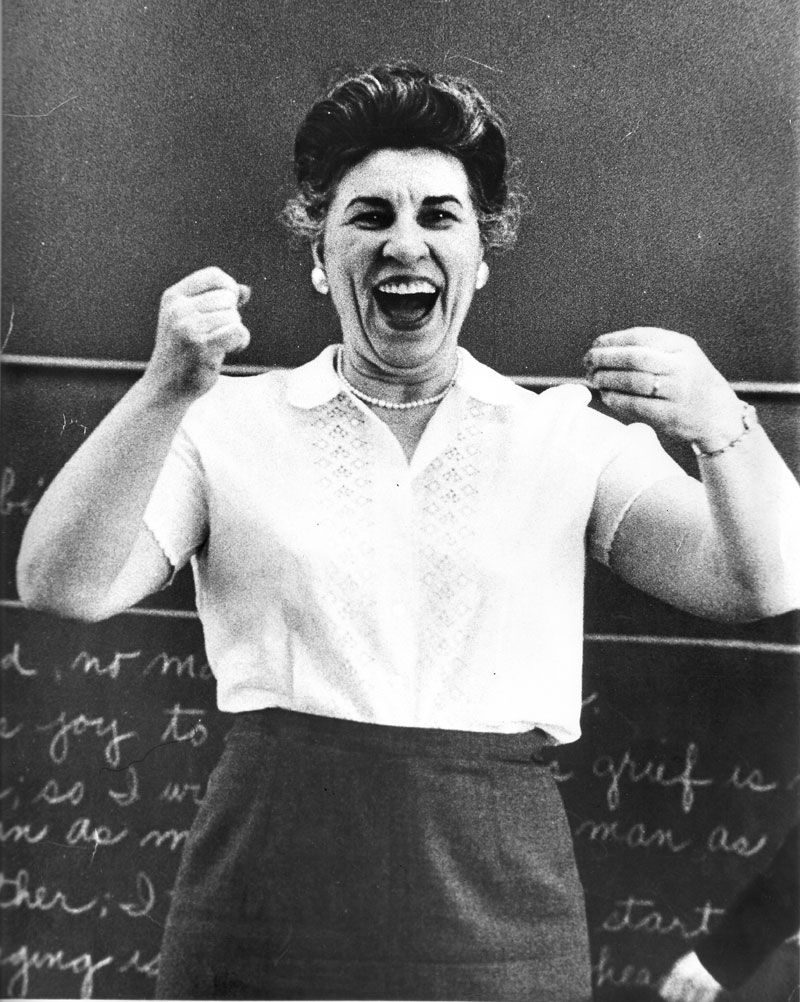

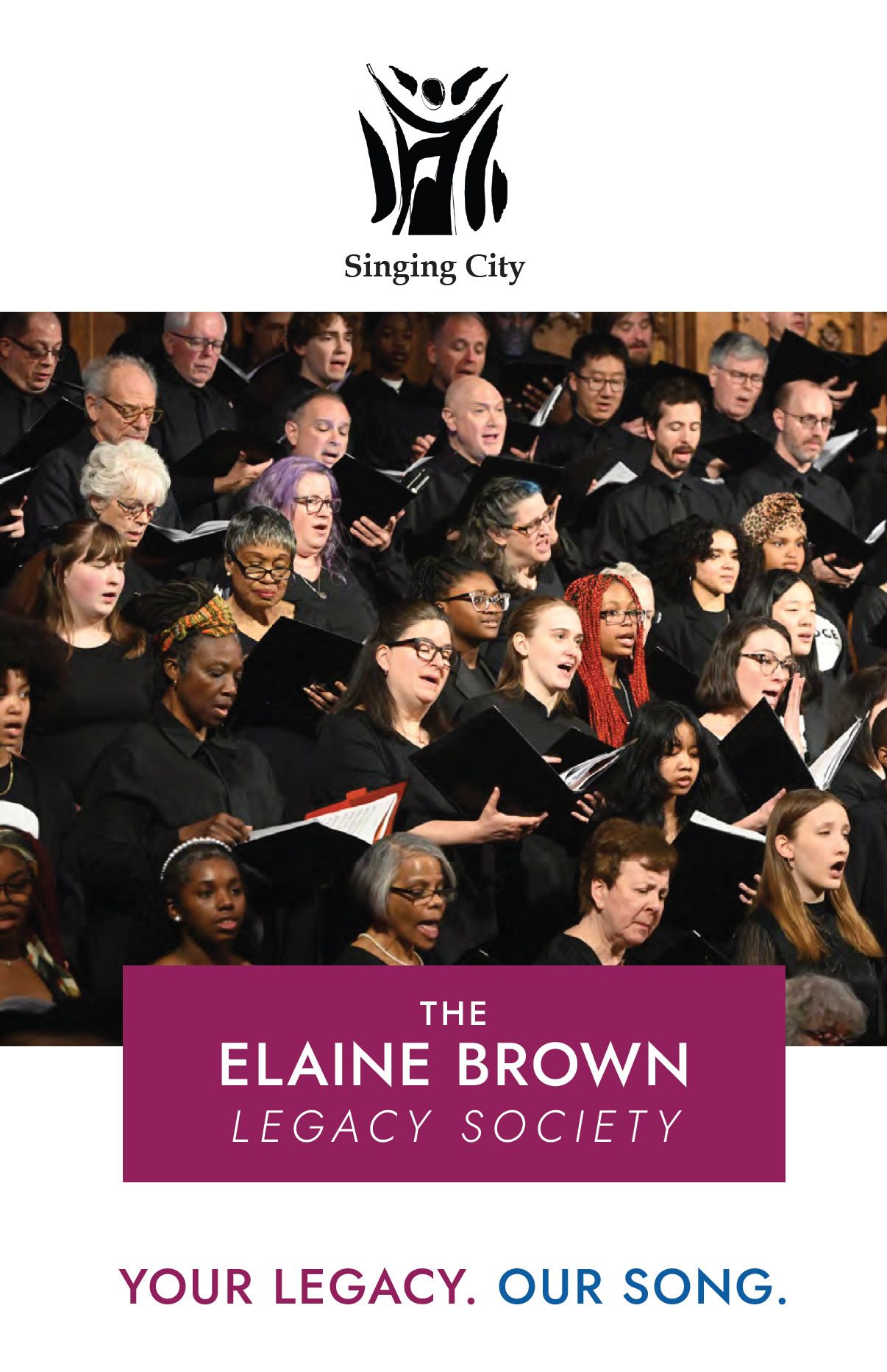

For more than 75 years, Singing City has been a beacon of what is possible when people of diverse backgrounds come together through choral music. In 1948, Elaine Brown’s heroic vision created one of the nation’s first integrated choirs. Our founding belief is simple and profound: people singing side by side can bridge divides and uplift the human spirit.

Singing City is more than a choir. We are a socially conscious vocal movement that educates, motivates, and empowers through song. We perform, teach, commission new works, and collaborate with civic and cultural partners across Philadelphia. Our work is made possible by people who believe in this mission. By including Singing City in your estate plans, you become a hero of this legacy—a champion of music, unity, and community. Your gift ensures that future generations will continue to experience the transformative power of music and connection.